Our purpose is to open up new futures in sustainable commercial real estate, creating compelling opportunities for our stakeholders and giving the world’s most ambitious companies the space to succeed.

Our strategy is to create value throughout the lifecycle of our assets: aiming to produce secure and predictable income streams and attractive returns over the long term.

We seek to do this via disciplined capital allocation and proactive ESG-led asset management, with our approach underpinned by appropriate financing.

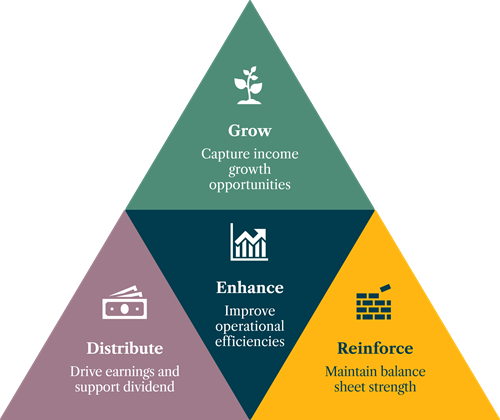

Our strategy comprises four priorities: